Franchise Development Lead Generation Spending Drives Ranking Changes Among Largest Sources

By: Michael Alston for Franchise Insights

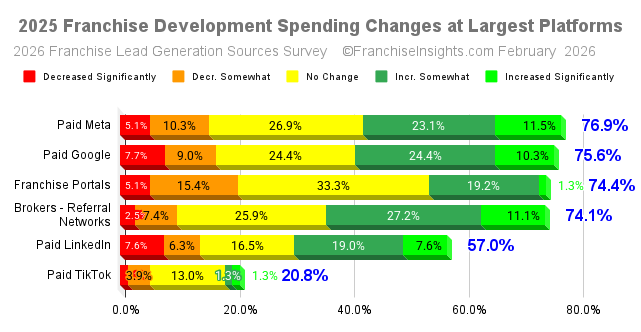

February 11, 2026 – When asked about spending changes among the largest sources of prospects in 2025, about 23.3% of franchise development teams already using Meta, Google, franchise directories (portals) or brokers said there was no change in their spending on these sources. On the other hand, 76.7% made tactical changes in their budget allocations.

After a year of dramatic changes in the lead generation environment, with the advent of AI-assisted search and a suspended but pending ban on TikTok in the U.S., along with regulatory and policy changes in the economy, franchises apportioned their spending accordingly.

Despite these challenges, 79% of franchise development teams either maintained or exceeded their expansion plans to pursue growth. Franchises increasing their expansion budgets (18.5%) included all tiers of system sizes.

Franchise development teams coalesced around four major platforms, after much experimentation in 2024

Almost 77% of franchise development teams made changes to their budget allocations in 2025, concentrating them among the top sources.

Meta was the largest source in terms of usage at 76.9%, though at almost exactly the same penetration as last year. Nonetheless, it displaced Google, which was the most used platform in 2025 but fell to second place at 75.6% in 2025 from our 2024 survey at 75.6%. But in terms of spending, more brands using Google chose to “decrease significantly” (7.7%) and fewer elected to “increase significantly”.

Franchise directories or “portals” as a category grew in usage share the most in absolute percentages, from 68.6% in 2024 to 74.4% in 2025 (a difference of 5.8%). One-third of franchise development teams made no changes to their budgets for this category in 2025. Franchise Insights is sponsored by Franchise Ventures, the largest franchise demand generation platform.

Meta gained the top position in usage over Google, while franchise directories (portals) rose to third place.

Brokers or Referral Networks notched a slight percentage gain in share of usage from 73.9% to 74.1% but dropped to fourth in usage ranking in 2025. On the other hand, the category had the highest share of spending increase at 27.2% (somewhat) and next to highest at 11.1% for “increased significantly.” Note that we will have greater insight into how cost changes impacted spending in coming analysis.

LinkedIn grew the most in relative percentage, from 52.2% to 57.0%, and maintained its fourth place ranking.

TikTok spending by franchise development teams dropped, with more teams decreasing spending somewhat (3.9%) or significantly (1.3%) in 2025. At the same time, TikTok shrank in usage, from 21.7% in 2024 to 20.8% in 2025 and was the smallest in usage overall for franchise lead generation. Legal and ownership challenges plagued the Chinese-owned company through 2025, though a U.S. consortium gained control of the company in January 22, resolving a pending legislative ban on access by U.S. consumers.

Supporting the validity of data from the Franchise Insights 2026 Franchise Development Lead Generation Sources survey, a broad cross-section of franchise development teams participated, from emerging systems to well-established franchises with many thousands of units.

FranchiseInsights.com surveys franchisors periodically to get a pulse on the industry, provides benchmarking and identifies franchise development best practices. This survey was conducted in late December 2025 and early January 2026.

We will continue to share additional franchise development best practices in upcoming articles at Franchise Insights.

Franchise Ventures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact Franchise Ventures to get your share of today’s aspiring franchise owners.

Published on Wednesday, February 11th, 2026.