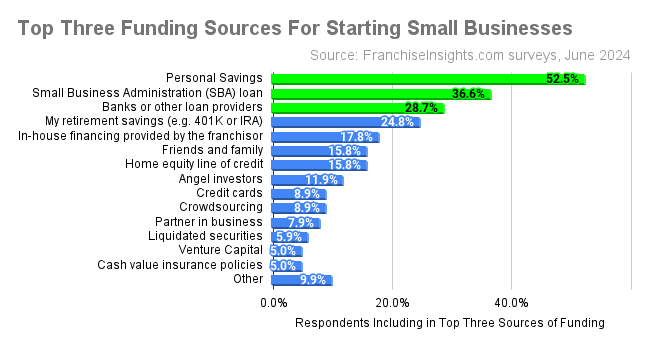

While Easier Credit is Likely Ahead, Aspiring Franchisees Still Rely Most on Personal Savings for Their Business Startups

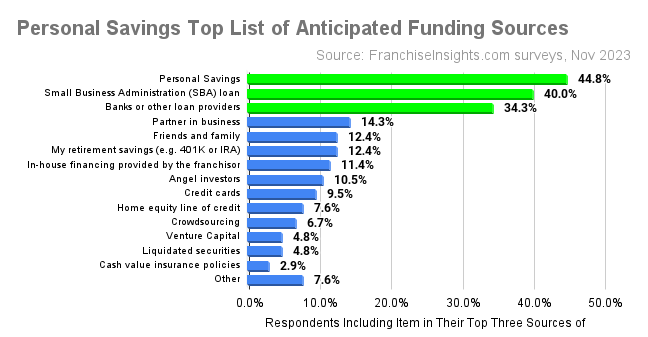

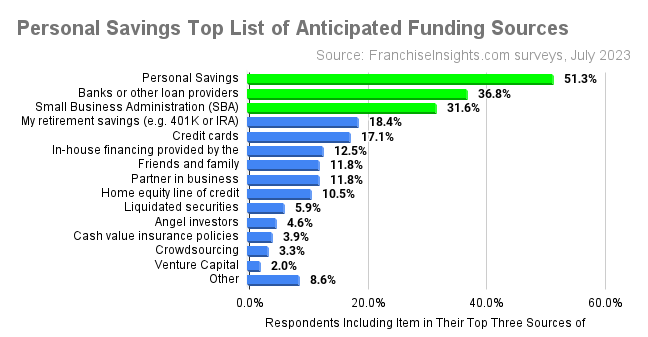

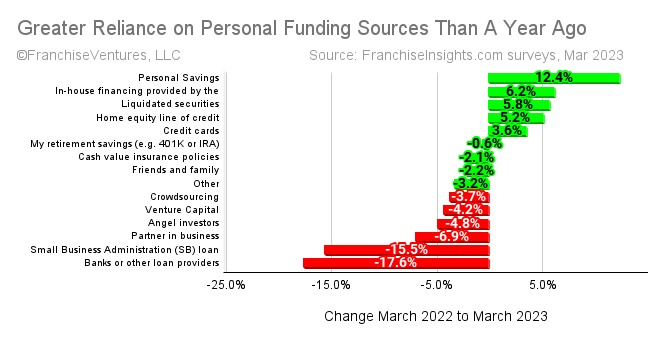

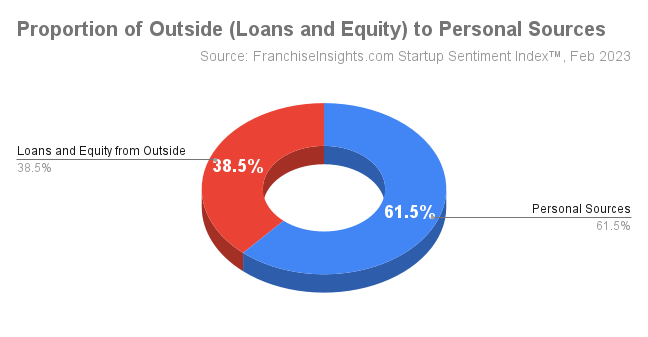

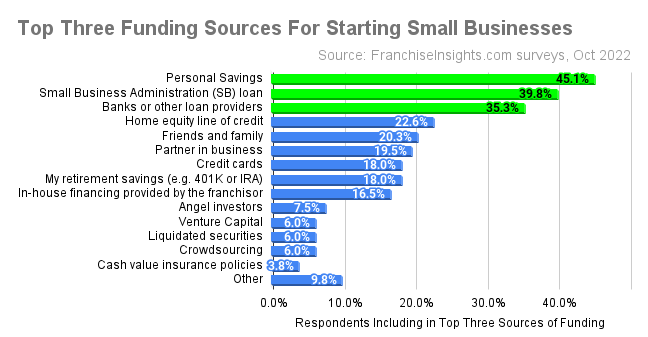

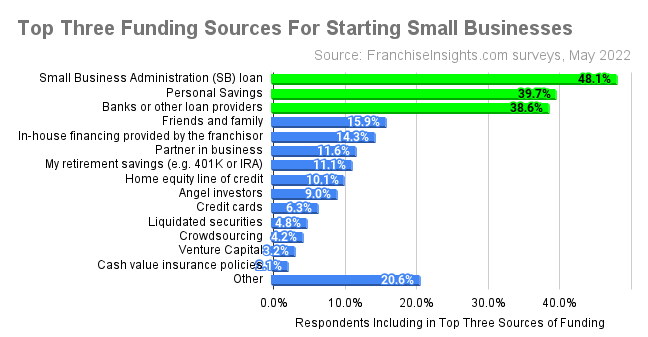

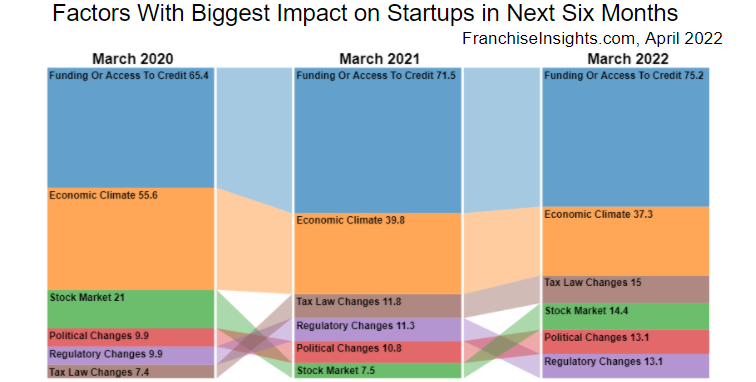

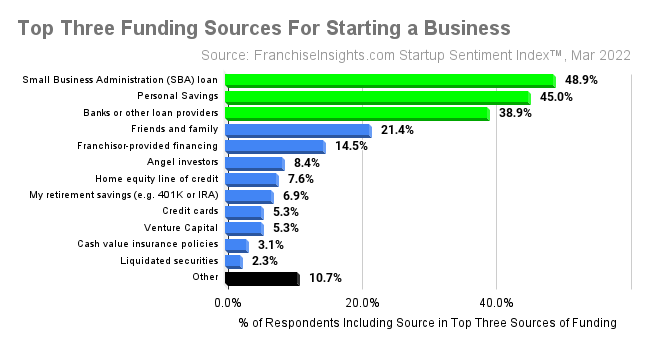

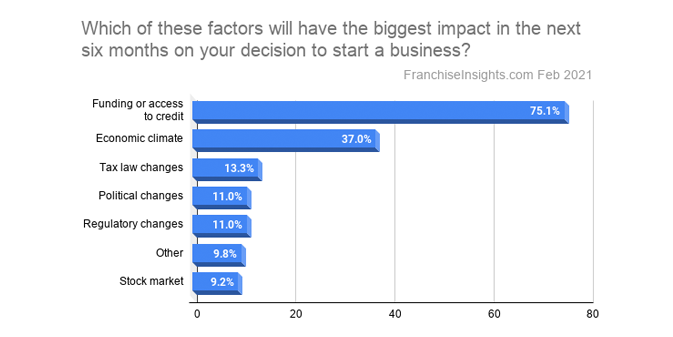

July 24, 2024 — With persistently higher interest rates and tighter credit, aspiring franchise owners look to diverse sources for financing their startups, especially from their own sources of capital, including personal savings, retirement funds, and home equity.