2020 Q4 Review Shows Resilient Franchise Categories Compared to Pre-Covid Results

Home Services, Senior Health Care and Cleaning and Maintenance Franchise Development Categories Grow Share Over Prior Year

Jan. 27, 2020 – As investment inquiries to franchises rose in almost all categories in December, the year end results also provide insight into which business categories are most resilient and grew their share of prospective franchisees’ interest. Results from Q4 2020 are particularly revealing when compared with Q4 2019, since that was the last quarter unaffected by the Covid-19 pandemic.

Analysis is based on data from the FranchiseVentures network of franchise lead generation brands, and insight into the pandemic’s effect comes at a time when business-startup optimism is rising, amid expectations that Covid-19 vaccines will ease the pandemic and restore economic activity in the months ahead. Optimism also rose for entrepreneurs planning to start a business both “this month” and “6 to 12 months out” in December’s Small Business Startup Sentiment Index ™ survey . (Download the full SSI survey results here.)

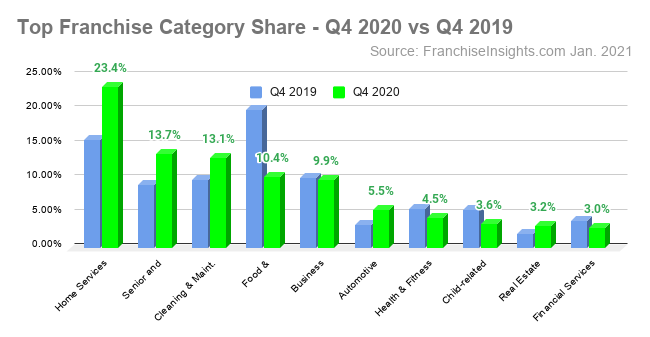

Franchise Categories Showing the Highest Volume

- Home Services franchises were the most popular category for franchises inquiries in Q4 2020, 23.4% share of inquiries. That’s up 49.1% from a year earlier, when it was the No. 2 most popular category.

- Senior and Health Care franchises and Cleaning and Maintenance franchises were the No. 2 and No. 3 most active categories, with 13.7% and 13.1% share, respectively. Both were no doubt propelled by increased demand brought on by the pandemic

- Food and Restaurant franchises fell to the No. 4 position, holding on to 10.4% of investment inquiries despite social-distancing concerns and public-health lockdowns that affect the past year’s business.

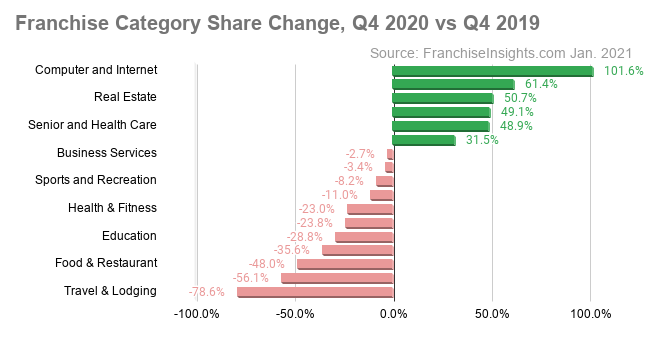

Franchise Categories Showing the Highest Growth

Franchise development categories with smaller shares saw the largest percentage increases in Q4 growth over the previous year.

- Computer and Internet franchises doubled their share of interest in Q4, growing 101.6% over Q4 2019. This specialized category captured just 0.9% share in Q4 2020. The category includes computer and cell phone repair services, Internet marketing franchises and outsourced IT services, and entrepreneurs may foresee strong demand for these services, anticipating the continuation of work-from-home trends during the pandemic.

- Automotive franchises are a mid-sized category that grew Q4 share 61%. Overall, it claimed 5.5% share among prospects seeking information about franchise ownership.

- Home Services franchises and Senior and Health Care franchises also showed strong Q4 growth (49.1% and 48.9%, respectively), and so did Cleaning and Maintenance franchises (31.5% growth over Q4 2019).

In a look ahead, future category growth will depend on the pace of vaccination and reopening, but hardest-hit categories are likely to show the highest growth in 2021 as businesses adjust to the coming shifts in consumer demand for travel, personal care, and eating out.

FranchiseVentures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact FranchiseVentures to get your share of today’s aspiring franchise owners.

Published on Wednesday, January 27th, 2021.