Personal Savings Tops Sources Expected for Funding Business Startups

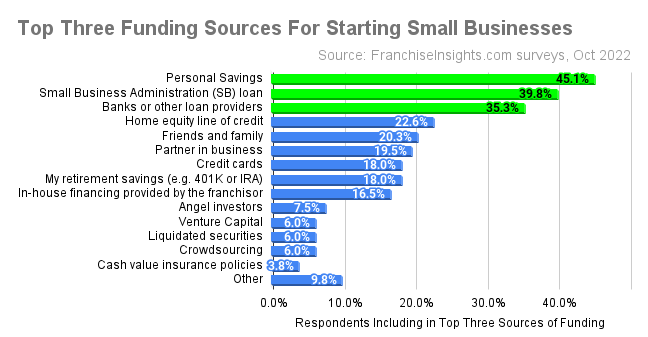

Norfolk, Virginia – November 9, 2022 — Most aspiring franchise buyers now plan to use their own personal sources of funding for their business launches. Those planning to take advantage of Small Business Administration loans and bank loans are at 39.8% and 35.3% respectively, despite forty-year highs in interest rates seen in the last few months. Another 16.5% of respondents are hoping to take advantage of in-house financing by the franchisor from whom they are purchasing.

For the first time in the history of this survey “personal savings” was the most often source selected, at 45.1% of respondents. “Friends and family” rose to 20.3%, and fell just below “home equity line of credit” at 22.6% of respondents.

These results are according to surveys of aspiring business owners conducted by FranchiseInsights.com in October 2022. The total percentages above add up to more than 100% since respondents were instructed to choose their top three sources.

The “other” option was chosen by 9.8% of respondents. The top “other” sources cited were as varied as “inherited IRA” and “sale of home,” among many more.

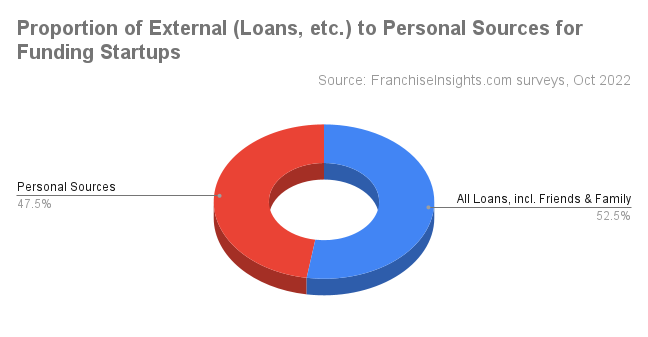

By aggregating sources into two buckets, we see that entrepreneurs are assuming that just under a half (47.5%) of startup capital sources will be from their own personal resources. The remaining 52.5% of sources will come from outside their balance sheets. “Other” sources were excluded from this view.

Personal Sources – for this analysis include personal savings, retirement funds (401K or IRA), credit cards, cash value insurance policies, and liquidation of securities. Though home equity lines of credit are technically a loan secured by the home, it was included for this analysis since it represents buyer equity.

Outside Sources – include Small Business Association (SBA) loans, banks or other loan providers, franchisor financing, venture capital, angel investors, and friends and family.

The “personal sources” share at 45.1% was up significantly from the 36.5% seen in May and the 33.8% seen in our analysis of startup funding sources back in March.

Undoubtedly higher interest rates are a key factor in the expected reliance on personal savings and sources of capital. Leverage to make a larger purchase and the tax deductibility of business interest go a long way to explain the popularity of debt among the top three sources of startup capital.

FranchiseInsights.com conducts a monthly “mystery shopping survey” as well as the Small Business Startup Sentiment Index™ (SSI) of individuals who have recently inquired about businesses for sale.The most recent Startup Sentiment Index™ survey was conducted October 20-31, 2022. Responses related to financing were collected from both instruments.

FranchiseVentures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact FranchiseVentures to get your share of today’s aspiring franchise owners.

Published on Tuesday, November 8th, 2022.