2025 Franchise Development Lead Sources Survey

by FranchiseInsights.com

Results of a survey of Franchise Development teams across system sizes, conducted in January 2025

©Franchise Ventures, LLC

April 30, 2025

This document is also available in pdf format here.

Abstract:

Franchise development teams are largely maintaining or increasing their expansion plans in 2024-2025. They have responded to changes in the lead generation ecosystem by aggressively diversifying their paid sources, in the face of rising cost per lead, to achieve growth goals and complement organic growth.

Key Observations

- In A Tumultuous 2024, Franchise Development Teams Stuck To Their Expansion Plans

- The Long Term Trend In Adoption Rates Shows Source Diversity Is The Dominant Strategy

- In 2025, The Largest Sources Grow Further In Usage, But The Smaller Ones Grow Faster

- Changes to The Search Ecosystem Drive Costs Higher

Summary

This document outlines trends and changes in franchise development lead generation from paid sources. Here is a summary:

Key Observations:

-

-

- Budget Expansion to Fund Growth: In 2024, 58% of franchise development teams maintained or expanded their growth plans despite business challenges, similar to 2023. Larger franchise systems, in particular, raised their goals and budgets.

- Lead Generation Paid Sources:

- Google remains the most widely-used paid lead generation source and is expected to see increased usage expand further in 2025.

- Meta has shown the fastest adoption rate in the last four years.

- Franchise portals are still widely used and expected to grow in usage in 2025.

- LinkedIn’s growth has stalled somewhat.

- TikTok is expected to grow the most from 2024 to 2025 despite potential app store exclusions and legal actions in several states.

- 2025 Spending: 100% of franchise development teams using major lead generation sources plan to increase spending on one or more of them in 2025.

- Cost Per Lead: Increased costs per lead were reported across most major sources (Google, Meta, Brokers/Referral Networks, and Franchise Portals).

- Survey Data: The data is based on a survey conducted in January 2025 with a broad cross-section of franchise development teams.

-

1 – Most Franchise Systems Stuck to Expansion Plans in 2024 Despite Business Challenges

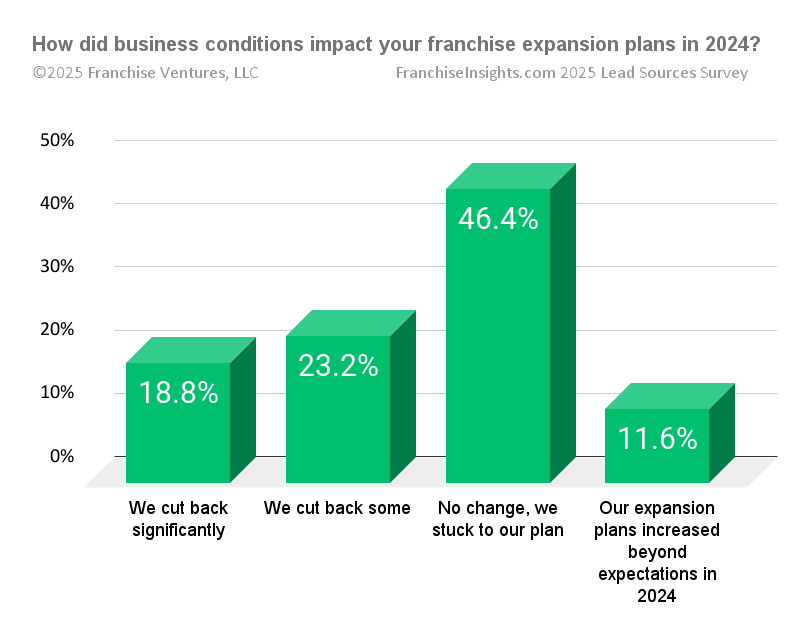

When asked about how business conditions impacted their expansion plans in 2024, 58% of franchise development teams said they stuck to their plans, or even expanded beyond expectations.

Coincidently, this is very close to the 58.3% seen in 2023. This is following 2023 wherein, despite tumultuous business conditions and shocking news headlines, more than 58% of franchisors surveyed either stuck to their growth plans (50.0%) or increased them (8.3%). Franchises increasing their expansion plans (8.3%) in 2023 were concentrated in the middle tiers of system size.

58% of Franchise Development teams maintained their expansion budgets or exceeded them to pursue growth in 2024.

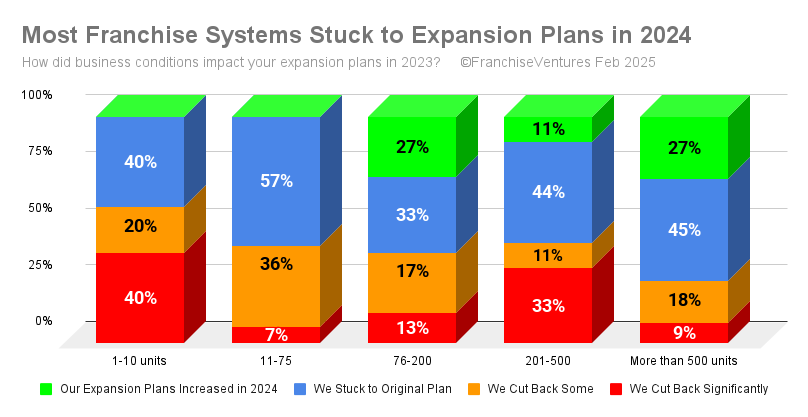

Franchise systems with 76-500+ U.S. units actually raised their goals and budgets as the year unfolded. Twenty-seven percent of franchise development teams representing systems with 201-500 units raised their goals during the year, the same percentage as reported by the 76-200 unit cohort.

A full 57% of the 11-75 unit systems stuck to their plans, and had the smallest percentage cutting back significantly at 7%.

The 1-10 unit segment reported the greatest reductions in expansion plans, at about 40%, yet another 40% in that cohort increased their plans.

Franchise developers are famous for leaning into the headwinds. Inflation, tight labor markets, and regulatory uncertainty did not keep most franchises from pursuing their growth plans.

2 – Adoption Rates for Franchise Development Lead Generation Sources

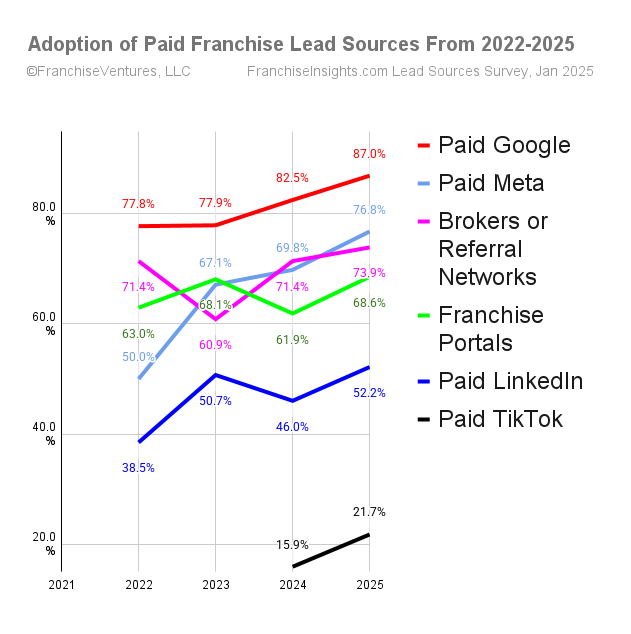

Looking back at usage rates of the top franchise development lead generation channels from 2022-2025, franchisors have diversified their sources in response to many changes in the ecosystem.

The chart above shows changes in usage among paid sources by franchise development teams, not the volume of leads or size of budget by channel.

Franchise development teams have diversified their paid channels for franchise lead generation significantly over the last several years.

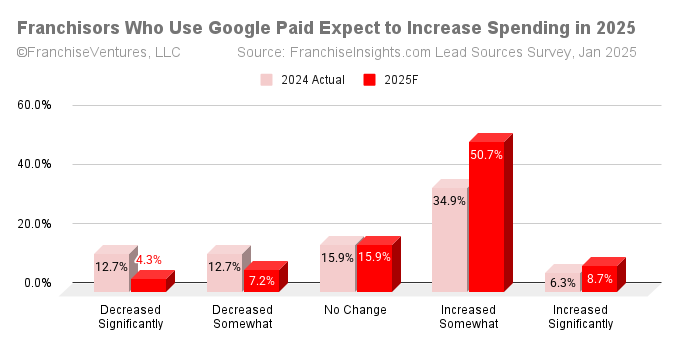

Google has gained further as the most widely-used lead generation source, despite the smaller real estate it provides for organic listings. Moreover, the advent of AI-assisted search reduced space for the popular sponsored “blue links.” Most all franchise development teams are using Google to some extent, and expect to use it more in 2025, now one full year after the introduction of AI overviews in search May 2024.

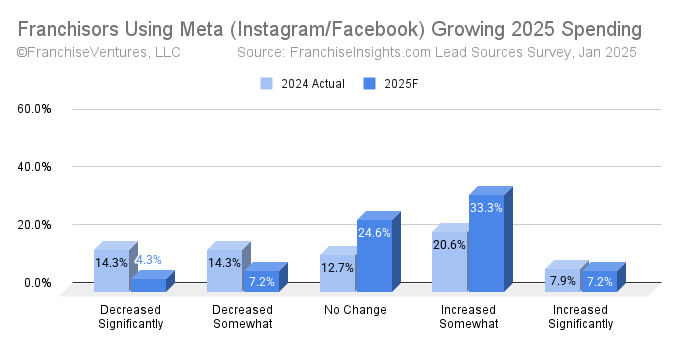

Meta has shown the fastest adoption rate, from 50% of teams to almost 77% of teams expecting to use the source in 2025. This shows a big gain despite the “ask apps not to track” feature introduced to devices using Apple iOS in April 2021 which cost Meta alone over $10 billion in ad revenue in that year.

The loss of tracking hampered targeting for all 3rd party sources, but Google and Meta have the offsetting advantages of broad consumer penetration and their own internal tracking features and ad options, and most of their users allow tracking to receive certain benefits (e.g. maps and navigation, content suggestions to follow interests, etc.).

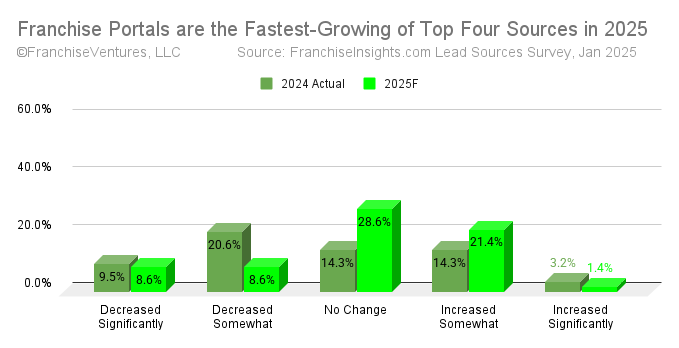

Franchise portals, after over thirty years of providing franchise leads, are still employed by most franchise development teams, and growing in usage in 2025.

Franchise portals, after providing franchise leads in some cases since at least 1994 (e.g. FranchiseSolutions.com and Franchise.com) , are still employed by most franchise development teams, and grew as a category from 61.9% in 2024 to an expected usage by 68.6% of systems in 2025, an increase of 11%. This is the highest growth rate among the top four sources in expected usage in 2025. Franchise Insights is sponsored by Franchise Ventures, a leading supplier of leads from portals.

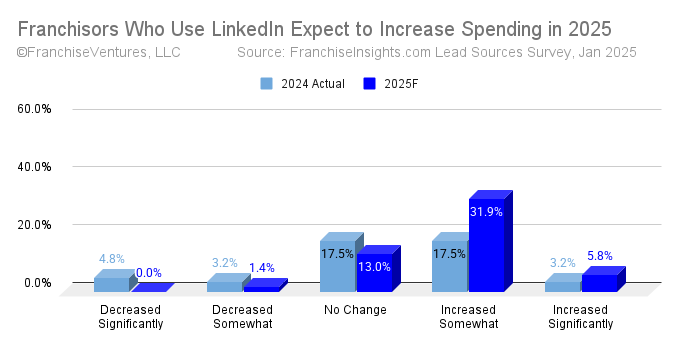

After rapid growth in 2023, LinkedIn stalled somewhat, with expected usage in 2025 just above 2023 levels.

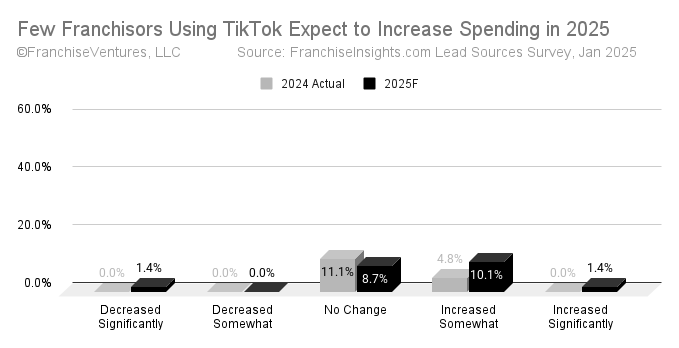

Finally, TikTok is expected to grow the most in breadth of usage from 2024 to 2025, despite the imminent threat of a ban from U.S. app stores, and a growing number of state-by-state bans over insufficient content controls that led to harmful content being pushed to children. About 22% of franchise systems nonetheless expect to experiment with TikTok in 2025.

3. Usage of Paid Sources Planned for 2025

When asked about advertising plans for 2025, 100% of franchise development teams already using the major franchise lead generation sources expected to increase their spending somewhat or significantly in 2025.

This is following a difficult 2024 where, despite challenging business conditions and the distractions of an election year, more than 58% of franchisors surveyed either stuck to their growth plans (50.0%) or increased them. Franchises increasing their expansion plans (8.3%) included all tiers of system sizes, and 98% of them increased their spending in 2024 across the four largest third-party advertising platforms.

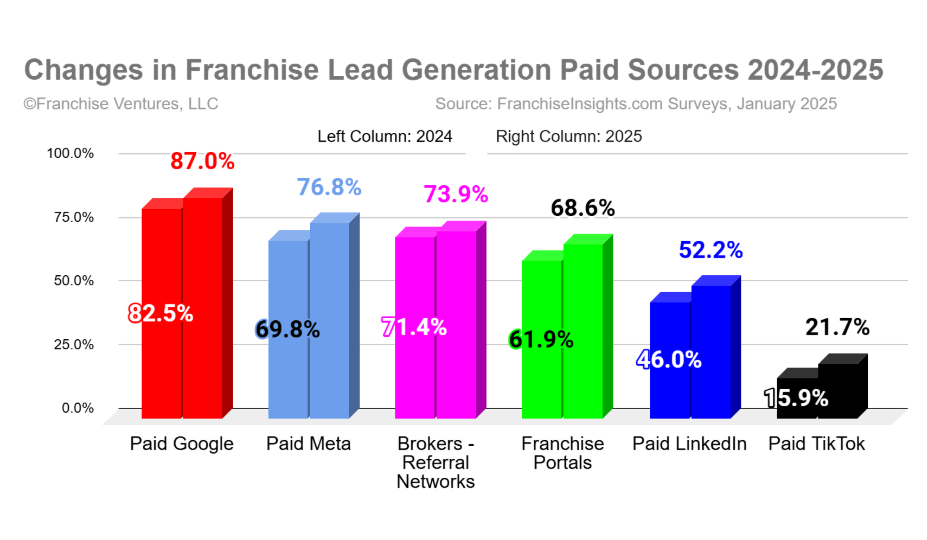

In 2025, 87% of franchisors expect to employ Google paid advertising (including YouTube), up from 82.5% in 2024.

Meta (Instagram and Facebook) rose to second place at 76.8% in anticipated usage for 2025, up from 69.8% in 2024, edging out usage of broker/referral networks.

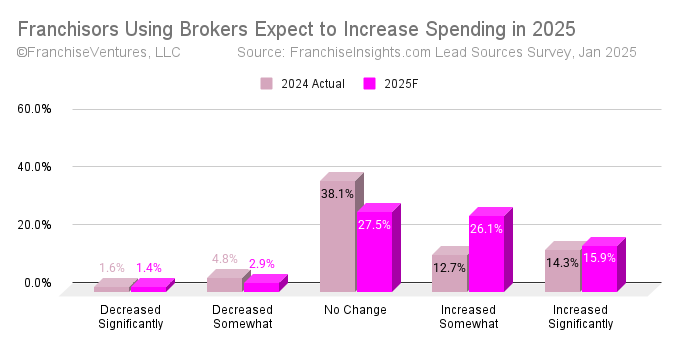

Brokers or Referral Networks fell to third in anticipated usage 73.9% in 2025, as Meta (Instagram/Facebook) rose to second place.

Franchise Portals as a group grew from 61.9% usage to 68.6%, an increase of 11%, the highest growth among the top four sources. Franchise Insights is sponsored by Franchise Ventures, the largest lead generation platform.

Franchise Portals will grow the most in usage in 2025 among the top four sources of franchise leads.

Only LinkedIn (grew 13%) and TikTok (grew 37%) grew faster in usage, though at 52.2% and 21.7% respectively, these were the least used sources for franchise development lead generation.

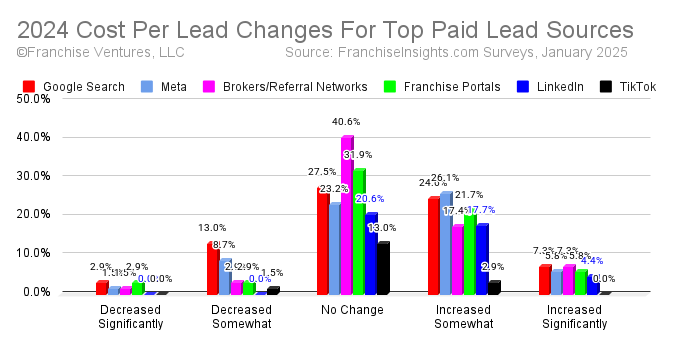

4. Changes in Cost Per Lead for Top Paid Franchise Development Lead Generation Sources

Most systems responding to the 2025 Franchise Development Lead Generation Survey anticipated increased spending in 2025, to which higher costs per lead were a factor for most sources.

In 2025, 87% of franchisors expect to employ Google paid advertising (including YouTube), up from 82.5% in 2024, despite 24.6% of them reporting that lead costs increased somewhat, and 7.3% significantly.

Meta (Facebook, Instagram, and Threads)

Meta (Instagram and Facebook) rose to second place at 76.8% in anticipated usage for 2025, up from 69.8% in 2024, while 26.1% of them reporting that lead costs increased somewhat, and 5.8% significantly.

Brokers & Referral Networks

Brokers and referral networks as a group grew from 71.4% usage to 73.9%, moving to third place among paid lead sources. Cost per lead for this source as a group was seen as increasing somewhat by 17.4% of systems reporting, and by 7.3% increasing significantly.

Franchise Portals

Franchise Portals as a group grew from 61.9% usage to 68.6%, an increase of 10.8%, the highest growth among the top four sources. Cost per lead for this lead source as a group was seen as increasing somewhat by 21.7% of systems reporting, and by 5.8% as increasing significantly. [Note: Franchise Insights is sponsored by Franchise Ventures, the largest lead generation platform.]

LinkedIn was used by 46% of franchise developers in 2024, while 17.7% of them reported that lead costs there increased somewhat, and 4.4% significantly.

TikTok

TikTok was used by only 15.9% of franchise developers in 2024, and 2.9% of them reported that lead costs increased somewhat, and none said they increased significantly.

| 2024 Lead Cost Change | Google Search | Meta | Brokers & Referral Networks | Franchise Portals | TikTok | |

| Decreased Significantly |

2.9% |

1.5% | 1.5% | 2.9% | 0.0% |

0.0% |

| Decreased Somewhat |

13.0% |

8.7% | 2.9% | 2.9% | 0.0% |

1.5% |

| No Change |

27.5% |

23.2% | 40.6% | 31.9% | 20.6% |

13.0% |

| Increased Somewhat |

24.6% |

26.1% | 17.4% | 21.7% | 17.7% |

2.9% |

| Increased Significantly |

7.3% |

5.8% | 7.3% | 5.8% | 4.4% | 0.0% |

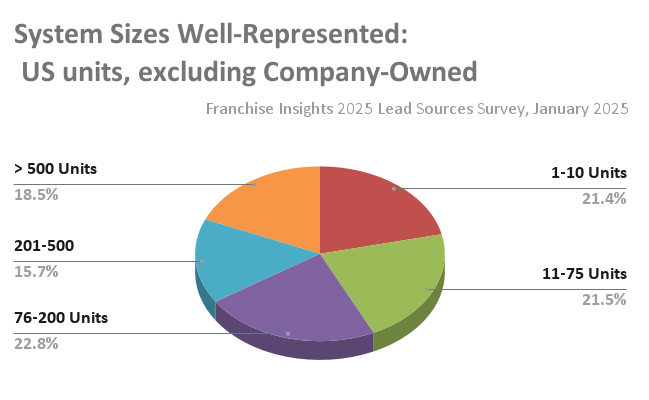

About the Survey Data

Supporting the validity of data from the Franchise Insights 2025 Franchise Lead Generation Sources survey, a broad cross-section of 131 franchise development teams participated (out of 205 total respondents), ranging from emerging systems to well-established franchises with many thousands of units.

Responses from business opportunities, consultants, brokers and other vendors were not included in this analysis.

FranchiseInsights.com surveys franchisors periodically to get a pulse on the industry, provide benchmarking and identify franchise development best practices. This survey was conducted in January 2025.

Franchise Ventures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact Franchise Ventures to get your share of today’s aspiring franchise owners.

Published on Wednesday, April 30th, 2025.