How Google and Apple Privacy Initiatives Are Likely to Impact Franchise Lead Generation

April 28, 2021 — In January 2020, Google announced that by 2022 its Chrome web browser would no longer allow sites’ collection of 3rd party user tracking “cookies.” Cookies are unique identifiers tied to a browser that track a user’s web behavior across the web and report that data back to the owner of the cookie. Mobile devices use a similar technology that can track specific behaviors on that device. Apple’s iOS (mobile device operating system) release 14.5 on April 26, 2021, lets users control which apps are allowed to track activity across other companies’ apps and websites. These changes, while designed to further consumer data privacy, will also have a significant impact on the options available to franchises for reaching and connecting with potential franchisees.

Conclusions:

- Effectiveness of some popular ad targeting and retargeting options will be challenged.

- Providers with ample and proprietary sources of leads are going to become ever more valuable.

Google Chrome Browser to Eliminate 3rd Party Cookies

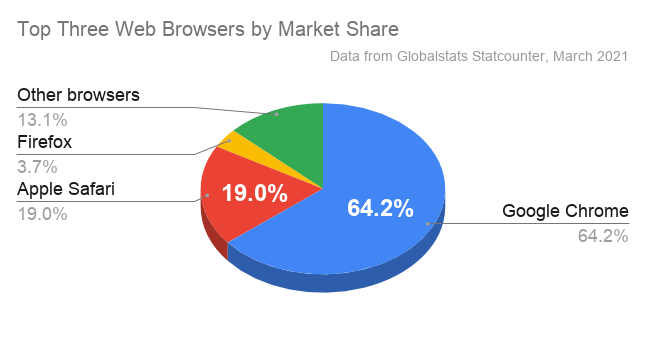

Already more than 64% of users are using Chrome to navigate the internet, with Apple’s Safari (19%) and Firefox (3.7%) close behind, according to March 2021 data from Globalstats Statcounter. Safari and Firefox already released browser versions with no-tracking as the default, so Chrome’s change will end the wide availability of 3rd party cookies. Rather than an arcane explanation of how this will change lead generation and why, here are a few common techniques used every day by franchises that will fade into the sunset.

- Retargeting your site users on other sites will be history. It is popular to place Google and Facebook retargeting tags on franchise development sites. This allows running ads on Google or Facebook that will be seen by users who previously visited your content — logically a more targeted individual. Google and Facebook will continue to offer retargeting of users from their own networks (first party cookies), but how effective this will be is unknown.

- Options for targeting individuals by interest will decrease. Dubbed “interest targeting”, Google offers the option to target individuals who have visited specific content types or sites (in addition to your own). This capability will be eliminated with the removal of Google’s third party cookies from websites. Again, Google will still, however, be able to offer targeting of behaviours from its own sites (e.g. someone who has searched on a franchise-related keyword).

- Similarly, popular Facebook targeting options by sites visited or content off Facebook will be eliminated where third party cookies are required, though as with Google, targeting options from data collection from Facebook’s own properties will remain.

Apple Prompts Users to Make Tracking Choices When Opening Apps

App analytics provider Appsflyer reports app opt-in rates (to allow tracking) on the order of 39%, which suggests a more than 60% reduction in targeting data from apps flowing to the ad targeting ecosystem.

- User behavior (e.g. researching franchises) will be significantly less available to third party sites like Facebook and Google for retargeting. Similar to websites, millions of apps collect and share user data (without identifying the user identity) as part of the ad targeting ecosystem, of which Google and Facebook are key beneficiaries, along with advertisers trying to reach specific interests. Examples would include apps visited and searches made. Google and Facebook will have to rely on data they collect themselves.

- Targeting data like demographics, geography, and financial wherewithal will no longer flow to Google and Facebook from other sites to aid in targeting. Gathering user data like this has enabled the targeting capabilities of Google and Facebook to yield higher return on investment. So the likely impact is lower returns and volume, except to the extent that Google and Facebook are able to collect similar data on their own platforms through first-party data.

The converse to all these changes is that first party data — that franchisors and suppliers gather on their own sites — will become significantly more valuable for targeting. Further, when lead generation portals provide contact information of persons requesting more information, that becomes “first party” data to the franchise client when contact is established. Optimizing the nurturing of those inquiries — through phone, text and drip email marketing channels — will continue to be critical skills in franchise development.

FranchiseVentures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact FranchiseVentures to get your share of today’s aspiring franchise owners.

Published on Wednesday, April 28th, 2021.