Startup Sentiment Rebounds in November

By: Michael Alston for Franchise Insights

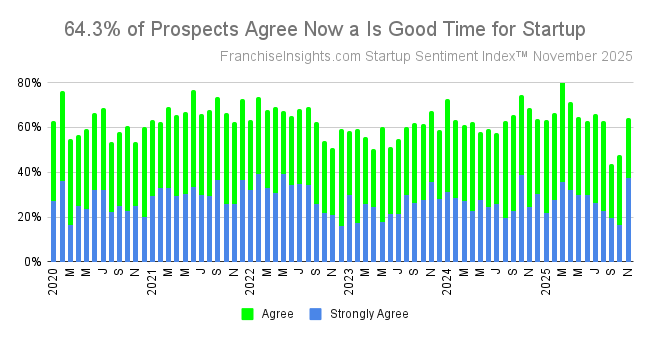

December 3, 2025 – Business buyer surveys in the last week of November 2025 showed 64.3% of persons exploring ownership agree or strongly agreed that “now is a good time for startup”, up dramatically from 43.9% in October.

This is despite consumer confidence dropping sharply in November’s Conference Board survey, which has been trending down over the last several months.

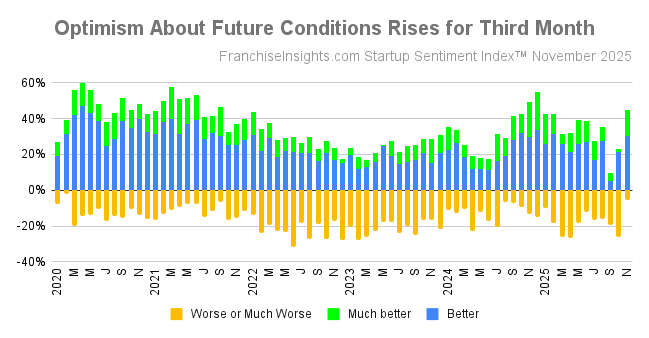

Further, 50.0% of respondents to the monthly sentiment survey see business conditions “about the same” in three months, with another 44.6% seeing them “better” or “much better” in early 2026.

Over 89.3% of respondents plan their startups within the next 12 months, the highest for that measure since December 2024.

Of this month’s respondents, 58.9% of entrepreneurs planned their startups within the next three months, just under the recent high of 64.3% in the April 2025 survey. It appears that the seasonal cycle of individuals doing their research for anticipated launches after the holidays is alive in 2025, with 73.2% of respondents in November expecting their launches within the next six months. The percentage of entrepreneurs planning their startups within the coming year stood at 89.3%, the highest since December of 2024.

In the November 2025 Small Business Startup Sentiment Index™ survey, 73.2% of respondents said they are “more or much more likely to launch their startups than three months ago,” up from 54.1% in October.

Additional Survey highlights:

- Future business conditions: Despite the uncertainty of tariff effects and policy changes ahead, 94.6% of respondents see conditions no worse – staying the same or getting better – in three months. Accordingly, only 5.4% of respondents see conditions getting “worse or much worse” in three months.

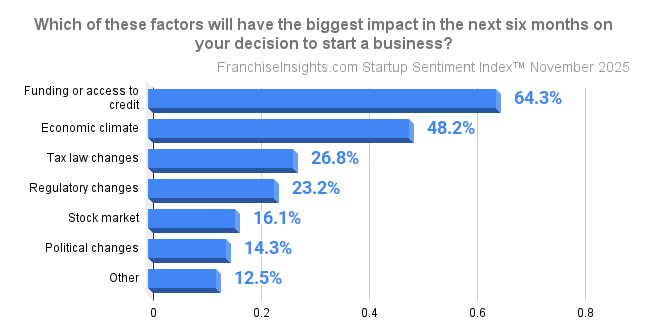

- Access to funding: 64.3% of entrepreneurs were concerned about finding adequate funding (the top concern), not far from the record low 53.1% seen in September 2024. On the other hand, those who see funding “harder or much harder” to obtain in the next three months dropped to 25% of respondents. “Economic climate” was second, followed by “tax law changes” as the third most cited factor impacting their startup timing.

- Current Employment: Of these survey respondents, 48.2% are currently employed full-time. Another 10.2% of respondents were current business owners seeking an additional or replacement business. Freelancers and consultants were 26.8%, while part-timers were 14.3%, and less than 1% were active military.

- Age Cohorts: Gen-X remains the largest share, at 57.7% of respondents, not far from the record 63.9% seen in June 2024. Boomers had a strong showing again this month at 13.5%, but below the 21.2% who were Gen-Y (Millennials), the largest cohort in the adult population, but years away from the peak age for business ownership. Gen-Z were at a recent high of 5.8%, and “Silent Generation” was less than 2% of respondents.

About 94.6% of respondents see business conditions “about the same” or “better or much better” in the next three months.

The FranchiseInsights.com Small Business Startup Sentiment Index™ (SSI) is based on a monthly survey of individuals who have recently inquired about businesses or franchises for sale on the Franchise Ventures lead generation platform. This survey was conducted November 23-30, 2025.

Franchise Ventures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact Franchise Ventures to get your share of today’s aspiring franchise owners.

Published on Tuesday, December 2nd, 2025.