Southeastern Cities Lead Top 100 Metros in New Franchise Interest Index™

March 10, 2020 – Atlanta, Ga., enjoys the nation’s highest interest in buying a franchise, according to the latest analysis of the Top 100 metropolitan areas.

March 10, 2020 – Atlanta, Ga., enjoys the nation’s highest interest in buying a franchise, according to the latest analysis of the Top 100 metropolitan areas.

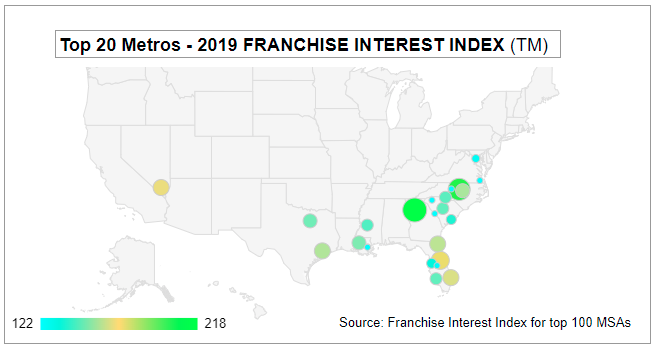

Southeastern metros dominated the top 20 leaders in the Franchise Interest Index(TM), with multiple major metro areas ranked in Florida and Texas, as well as high-interest from mid-sized metros in North and South Carolina.

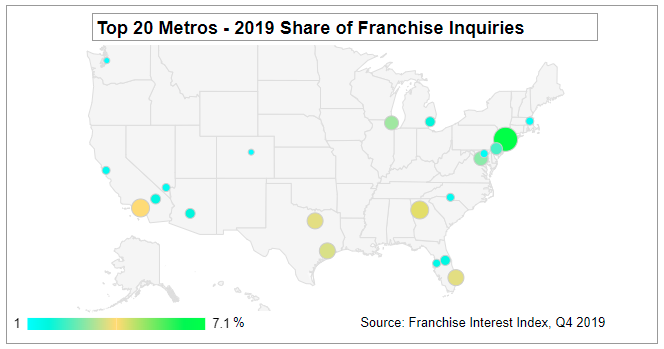

While the nation’s largest population centers lead the overall volume of franchise inquiries, the Franchise Interest Index(TM) highlights regions of any size where entrepreneurial interest is higher than average, a signal of future business investment and economic growth potential.

The analysis applied the Franchise Interest Index(TM) to 106 MSAs (metropolitan statistical areas) with more than 500,000 in total population. Using franchise-investment inquiries drawn from the Franchise Ventures’ proprietary demand-generation platform, the Franchise Interest IndexTM reveals the relative interest of entrepreneurs indexed to adult population age 22+ on a per capita basis for the full year of 2019.

The Atlanta MSA led the Top 10 with an index of 218 last year, more than twice the average interest in franchising. As the largest metro in the state, Atlanta clearly helped propel Georgia to the top state in the Franchise Interest IndexTM for the year.

The Atlanta MSA led the Top 10 with an index of 218 last year, more than twice the average interest in franchising. As the largest metro in the state, Atlanta clearly helped propel Georgia to the top state in the Franchise Interest IndexTM for the year.- Atlanta was one of four regions in the Top 10 with populations over 5 million. The other major metros in the Top 10 were the Miami-Ft. Lauderdale at No. 5, Houston at No. 7, and Dallas-Fort Worth at No. 10.

- Large metros with population between 1 million and 5 million claimed another four spots in the top – Orlando, with an index of 174, was No. 3, Las Vegas was No. 4, Jacksonville, Fla., was No. 6, and Raleigh, N.C, was No. 8.

- Mid-sized metros with population between 500,000 and 1 million claimed two more spots in the Top 10 for entrepreneurial interest. Durham-Chapel, N.C., was No. 2 overall, with an index of 203, and Baton Rouge, La., was No. 9 with an index of 148.

Here is a full list of the Top 100 MSAs in the Franchise Interest IndexTM. An index of 100 indicates average per-capita interest, while an index of 120 represents 20% higher-than-average interest.

Metro Areas Ranked by Franchise Interest Index(TM)

| Metro MSA | Franchise Interest Index TM 2019 | |

|---|---|---|

| 1. | Atlanta-Sandy Springs-Roswell, GA | 218 |

| 2. | Durham-Chapel Hill, NC | 203 |

| 3. | Orlando-Kissimmee-Sanford, FL | 174 |

| 4. | Las Vegas-Henderson-Paradise, NV | 166 |

| 5. | Miami-Fort Lauderdale-West Palm Beach, FL | 163 |

| 6. | Jacksonville, FL | 158 |

| 7. | Houston-The Woodlands-Sugar Land, TX | 156 |

| 8. | Raleigh, NC | 155 |

| 9. | Baton Rouge, LA | 148 |

| 10. | Dallas-Fort Worth-Arlington, TX | 146 |

| 11. | Cape Coral-Fort Myers, FL | 144 |

| 12. | Columbia, SC | 144 |

| 13. | Charlotte-Concord-Gastonia, NC-SC | 143 |

| 14. | Jackson, MS | 142 |

| 15. | Charleston-North Charleston, SC | 137 |

| 16. | Tampa-St. Petersburg-Clearwater, FL | 134 |

| 17. | Washington-Arlington-Alexandria, DC-VA-MD-WV | 125 |

| 18. | Lakeland-Winter Haven, FL | 124 |

| 19. | New Orleans-Metairie, LA | 123 |

| 20. | Virginia Beach-Norfolk-Newport News, VA-NC | 122 |

| 21. | Greenville-Anderson-Mauldin, SC | 122 |

| 22. | Augusta-Richmond County, GA-SC | 122 |

| 23. | Greensboro-High Point, NC | 122 |

| 24. | Stockton-Lodi, CA | 117 |

| 25. | Little Rock-North Little Rock-Conway, AR | 114 |

| 26. | Baltimore-Columbia-Towson, MD | 114 |

| 27. | Colorado Springs, CO | 113 |

| 28. | Richmond, VA | 112 |

| 29. | Provo-Orem, UT | 111 |

| 30. | Birmingham-Hoover, AL | 110 |

| 31. | Detroit-Warren-Dearborn, MI | 110 |

| 32. | Memphis, TN-MS-AR | 110 |

| 33. | Indianapolis-Carmel-Anderson, IN | 110 |

| 34. | Austin-Round Rock, TX | 108 |

| 35. | North Port-Sarasota-Bradenton, FL | 108 |

| 36. | Deltona-Daytona Beach-Ormond Beach, FL | 107 |

| 37. | San Antonio-New Braunfels, TX | 103 |

| 38. | El Paso, TX | 101 |

| 39. | Palm Bay-Melbourne-Titusville, FL | 101 |

| 40. | Winston-Salem, NC | 101 |

| 41. | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 101 |

| 42. | Columbus, OH | 100 |

| 43. | Riverside-San Bernardino-Ontario, CA | 100 |

| 44. | Phoenix-Mesa-Scottsdale, AZ | 100 |

| 45. | Sacramento–Roseville–Arden-Arcade, CA | 99 |

| 46. | Bridgeport-Stamford-Norwalk, CT | 98 |

| 47. | Cleveland-Elyria, OH | 98 |

| 48. | Denver-Aurora-Lakewood, CO | 97 |

| 49. | Akron, OH | 97 |

| 50. | New York-Newark-Jersey City, NY-NJ-PA | 96 |

| 51. | Lexington-Fayette, KY | 96 |

| 52. | Nashville-Davidson–Murfreesboro–Franklin, TN | 96 |

| 53. | Allentown-Bethlehem-Easton, PA-NJ | 93 |

| 54. | Modesto, CA | 91 |

| 55. | Oxnard-Thousand Oaks-Ventura, CA | 91 |

| 56. | Louisville/Jefferson County, KY-IN | 90 |

| 57. | Tulsa, OK | 90 |

| 58. | McAllen-Edinburg-Mission, TX | 90 |

| 59. | St. Louis, MO-IL | 89 |

| 60. | Boise City, ID | 89 |

| 61. | Chicago-Naperville-Elgin, IL-IN-WI | 88 |

| 62. | Bakersfield, CA | 88 |

| 63. | Omaha-Council Bluffs, NE-IA | 87 |

| 64. | Oklahoma City, OK | 86 |

| 65. | Kansas City, MO-KS | 84 |

| 66. | Fayetteville-Springdale-Rogers, AR-MO | 83 |

| 67. | Los Angeles-Long Beach-Anaheim, CA | 83 |

| 68. | Milwaukee-Waukesha-West Allis, WI | 81 |

| 69. | Cincinnati, OH-KY-IN | 80 |

| 70. | Harrisburg-Carlisle, PA | 78 |

| 71. | Salt Lake City, UT | 78 |

| 72. | Des Moines-West Des Moines, IA | 77 |

| 73. | Toledo, OH | 77 |

| 74. | Chattanooga, TN-GA | 76 |

| 75. | New Haven-Milford, CT | 76 |

| 76. | Ogden-Clearfield, UT | 75 |

| 77. | San Francisco-Oakland-Hayward, CA | 74 |

| 78. | San Jose-Sunnyvale-Santa Clara, CA | 74 |

| 79. | Albuquerque, NM | 74 |

| 80. | San Diego-Carlsbad, CA | 73 |

| 81. | Minneapolis-St. Paul-Bloomington, MN-WI | 72 |

| 82. | Seattle-Tacoma-Bellevue, WA | 71 |

| 83. | Hartford-West Hartford-East Hartford, CT | 70 |

| 84. | Wichita, KS | 69 |

| 85. | Knoxville, TN | 69 |

| 86. | Scranton–Wilkes-Barre–Hazleton, PA | 68 |

| 87. | Springfield, MA | 68 |

| 88. | Worcester, MA-CT | 67 |

| 89. | Youngstown-Warren-Boardman, OH-PA | 67 |

| 90. | Fresno, CA | 66 |

| 91. | Tucson, AZ | 66 |

| 92. | Urban Honolulu, HI | 66 |

| 93. | Pittsburgh, PA | 66 |

| 94. | Lancaster, PA | 65 |

| 95. | Boston-Cambridge-Newton, MA-NH | 65 |

| 96. | Buffalo-Cheektowaga-Niagara Falls, NY | 65 |

| 97. | Grand Rapids-Wyoming, MI | 62 |

| 98. | Spokane-Spokane Valley, WA | 62 |

| 99. | Rochester, NY | 60 |

| 100. | Providence-Warwick, RI-MA | 59 |

| 101. | Albany-Schenectady-Troy, NY | 58 |

| 102. | Syracuse, NY | 58 |

| 103. | Portland-Vancouver-Hillsboro, OR-WA | 57 |

| 104. | Madison, WI | 54 |

| 105. | Santa Rosa, CA | 51 |

| 106. | Portland-South Portland, ME | 47 |

FranchiseVentures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact FranchiseVentures to get your share of today’s aspiring franchise owners.

Published on Tuesday, March 10th, 2020.